W8 Form Instructions

W8 Form Instructions - Manage tax obligations on u.s. You may be required to provide a. You must notify the withholding agent or payer within 30 days of becoming a u.s.

Manage tax obligations on u.s. You may be required to provide a. You must notify the withholding agent or payer within 30 days of becoming a u.s.

You must notify the withholding agent or payer within 30 days of becoming a u.s. You may be required to provide a. Manage tax obligations on u.s.

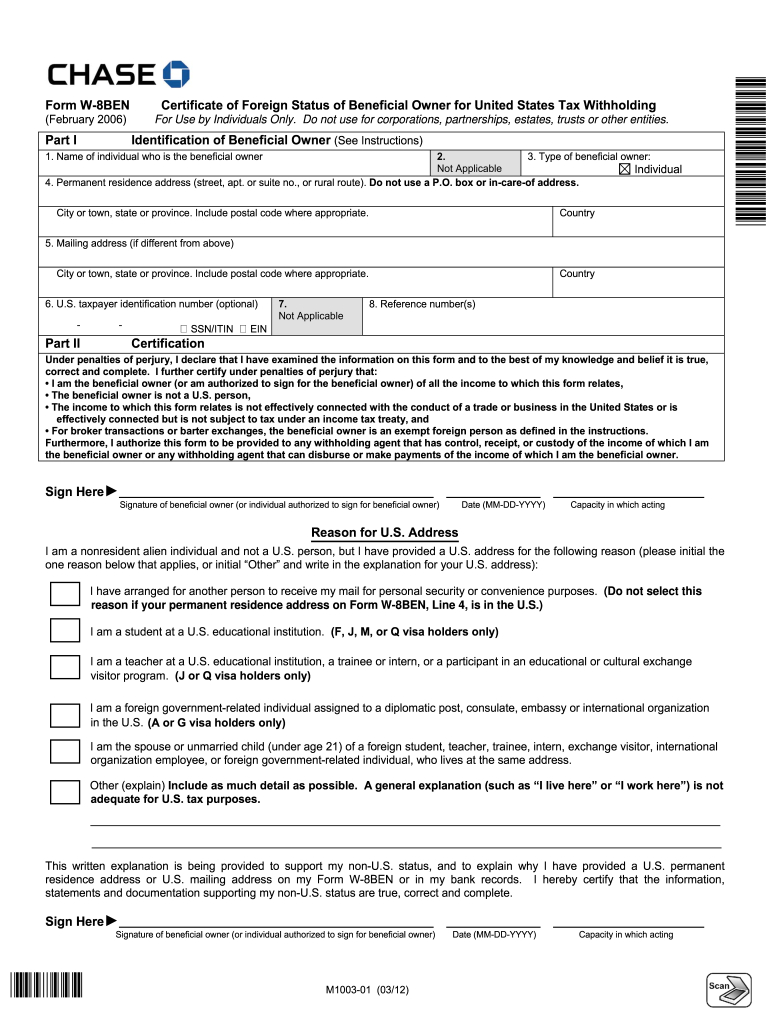

Irs Form W8 Printable Example Calendar Printable

You may be required to provide a. You must notify the withholding agent or payer within 30 days of becoming a u.s. Manage tax obligations on u.s.

W8BEN Form Instructions for Canadians Cansumer

You must notify the withholding agent or payer within 30 days of becoming a u.s. Manage tax obligations on u.s. You may be required to provide a.

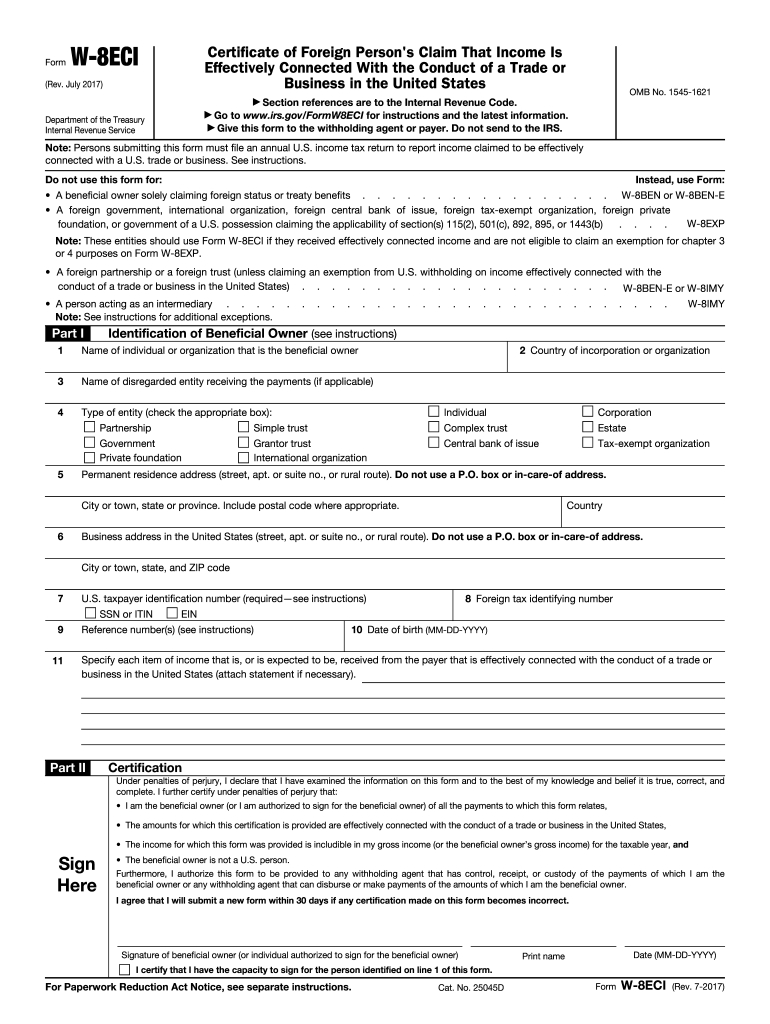

How to fill W8BEN Form for affiliate platforms like Chitika, Infolinks

You may be required to provide a. You must notify the withholding agent or payer within 30 days of becoming a u.s. Manage tax obligations on u.s.

Irs Form W8 Printable Example Calendar Printable

Manage tax obligations on u.s. You must notify the withholding agent or payer within 30 days of becoming a u.s. You may be required to provide a.

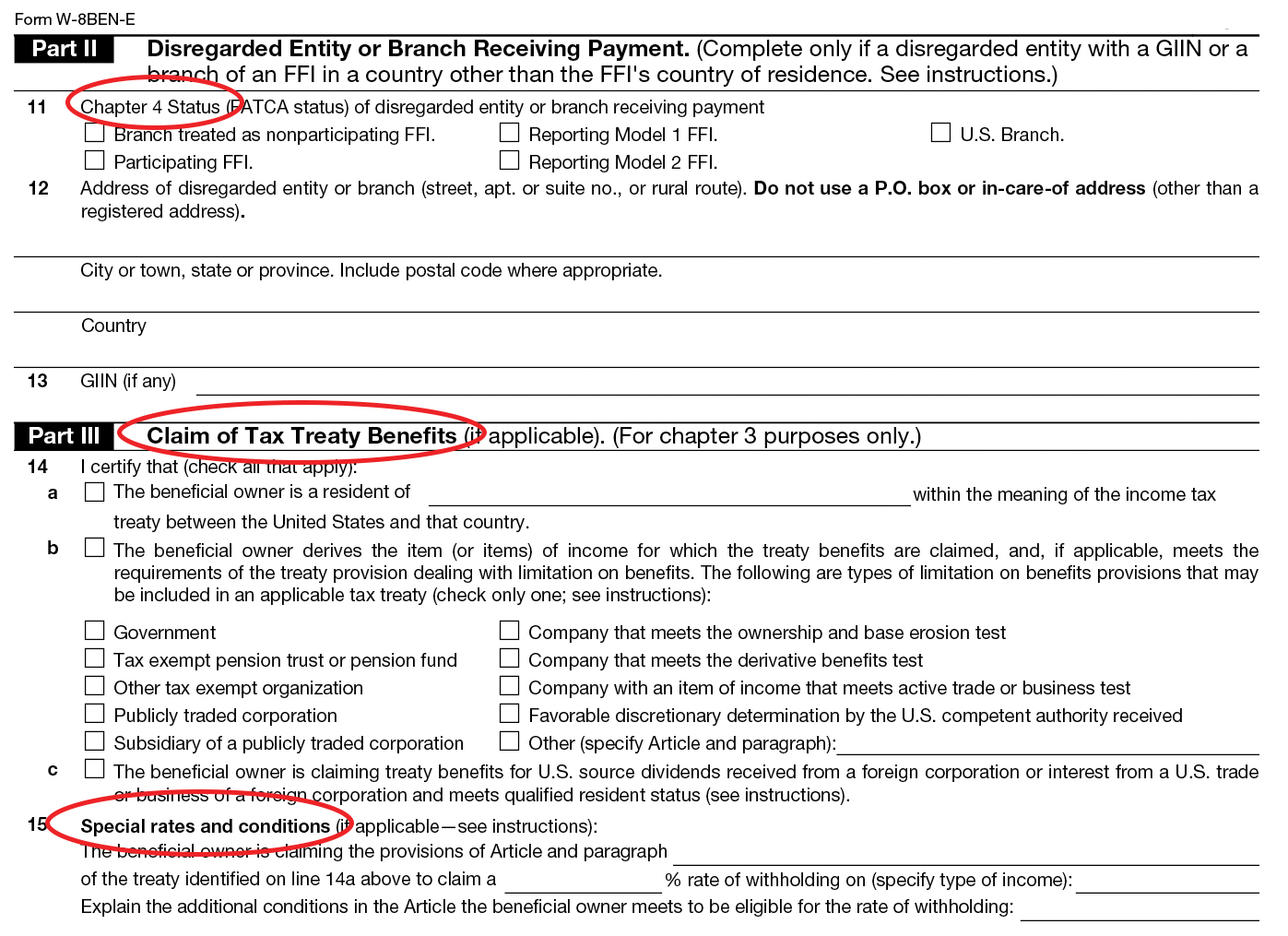

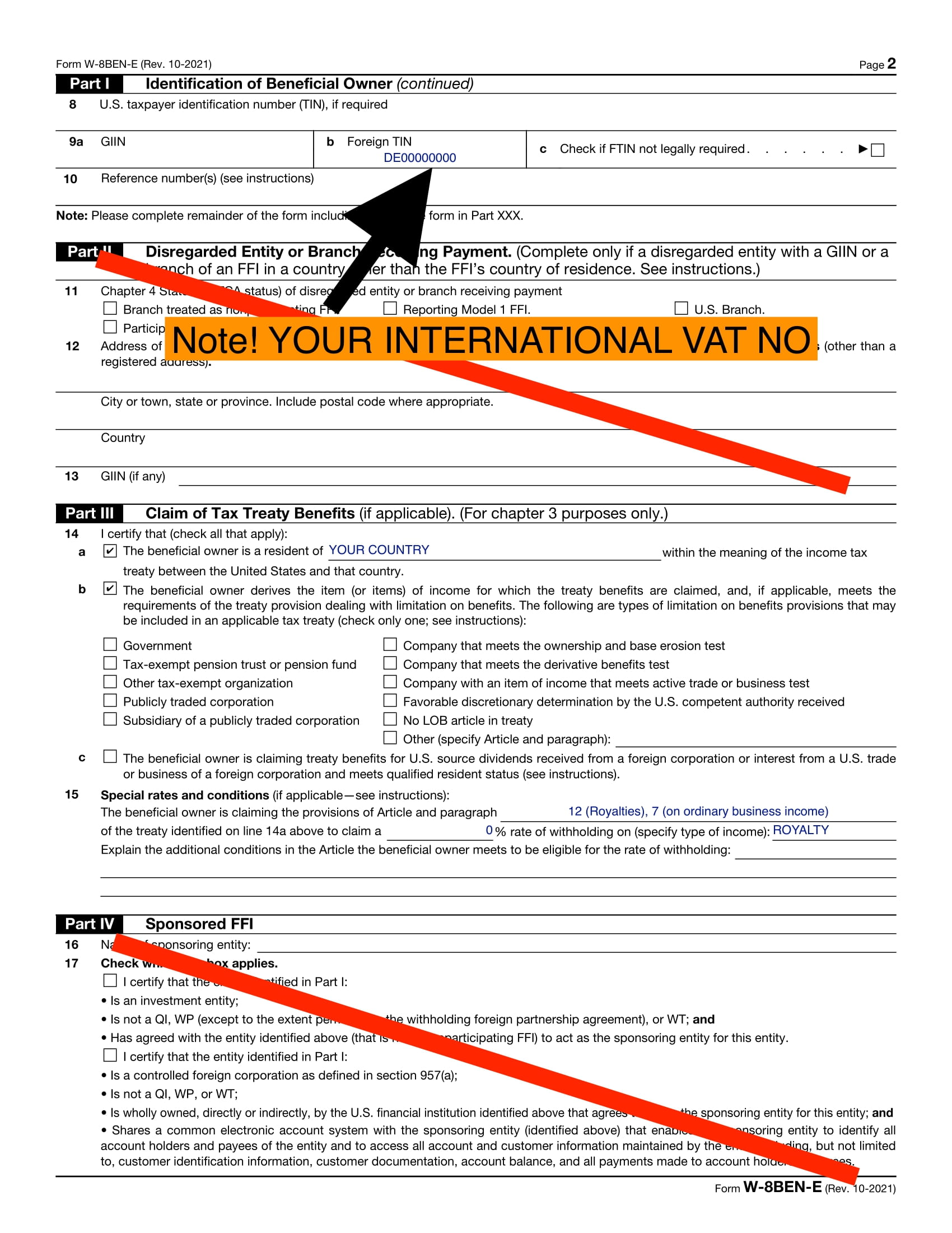

W 8ben E Fillable Form Printable Forms Free Online

Manage tax obligations on u.s. You must notify the withholding agent or payer within 30 days of becoming a u.s. You may be required to provide a.

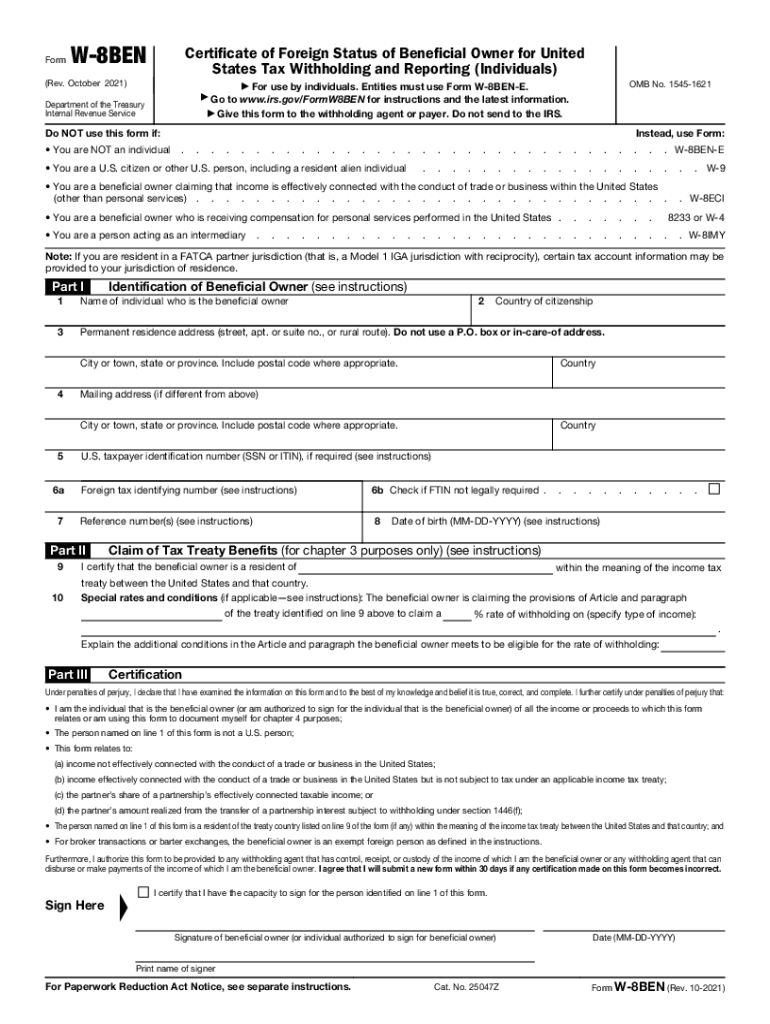

W 8ben Fill out & sign online DocHub

You may be required to provide a. You must notify the withholding agent or payer within 30 days of becoming a u.s. Manage tax obligations on u.s.

W8 Forms Definition

You may be required to provide a. Manage tax obligations on u.s. You must notify the withholding agent or payer within 30 days of becoming a u.s.

Irs Form W8 Printable Example Calendar Printable

Manage tax obligations on u.s. You must notify the withholding agent or payer within 30 days of becoming a u.s. You may be required to provide a.

W8 Withholding Tax Limited Liability Company

Manage tax obligations on u.s. You must notify the withholding agent or payer within 30 days of becoming a u.s. You may be required to provide a.

You May Be Required To Provide A.

You must notify the withholding agent or payer within 30 days of becoming a u.s. Manage tax obligations on u.s.

:max_bytes(150000):strip_icc()/W-8IMY-1-42d7af5b144642ff8971186f2395ba69.png)