What Is An Origination Fee On A Loan Everfi

What Is An Origination Fee On A Loan Everfi - An origination fee is a charge levied by lenders to process a new loan application, and is typically expressed as a percentage of the total loan. A fee that is charged by a lender to make up for the cost that they spend giving you a loan. Study with quizlet and memorize flashcards containing terms like when dealing with loan origination fees, one point is equal to, what is. How often do you need to. A percentage of the loan that is charged to cover the cost of giving the loan is known as _____. What is an origination fee on a loan? Origination fee the _____ is the additional costs you pay each.

A percentage of the loan that is charged to cover the cost of giving the loan is known as _____. What is an origination fee on a loan? An origination fee is a charge levied by lenders to process a new loan application, and is typically expressed as a percentage of the total loan. Study with quizlet and memorize flashcards containing terms like when dealing with loan origination fees, one point is equal to, what is. Origination fee the _____ is the additional costs you pay each. A fee that is charged by a lender to make up for the cost that they spend giving you a loan. How often do you need to.

An origination fee is a charge levied by lenders to process a new loan application, and is typically expressed as a percentage of the total loan. A fee that is charged by a lender to make up for the cost that they spend giving you a loan. How often do you need to. What is an origination fee on a loan? Origination fee the _____ is the additional costs you pay each. A percentage of the loan that is charged to cover the cost of giving the loan is known as _____. Study with quizlet and memorize flashcards containing terms like when dealing with loan origination fees, one point is equal to, what is.

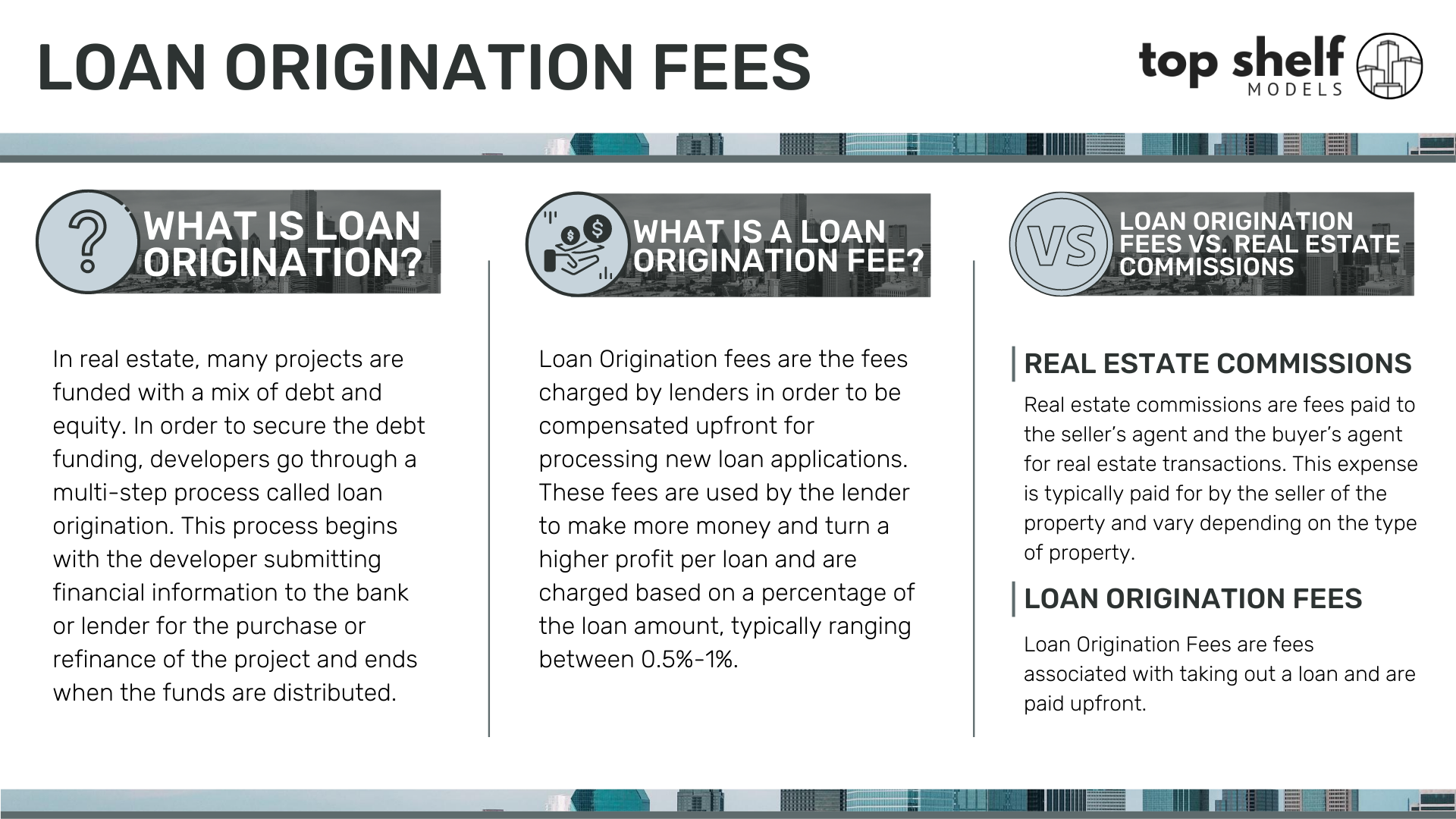

What Are Loan Origination Fees? — Top Shelf® Models

A fee that is charged by a lender to make up for the cost that they spend giving you a loan. Origination fee the _____ is the additional costs you pay each. An origination fee is a charge levied by lenders to process a new loan application, and is typically expressed as a percentage of the total loan. Study with.

Loan Origination Fees

How often do you need to. Study with quizlet and memorize flashcards containing terms like when dealing with loan origination fees, one point is equal to, what is. A fee that is charged by a lender to make up for the cost that they spend giving you a loan. Origination fee the _____ is the additional costs you pay each..

Loan Origination Fee 101 What Is it & Do I Have to Pay It?

How often do you need to. Study with quizlet and memorize flashcards containing terms like when dealing with loan origination fees, one point is equal to, what is. A fee that is charged by a lender to make up for the cost that they spend giving you a loan. An origination fee is a charge levied by lenders to process.

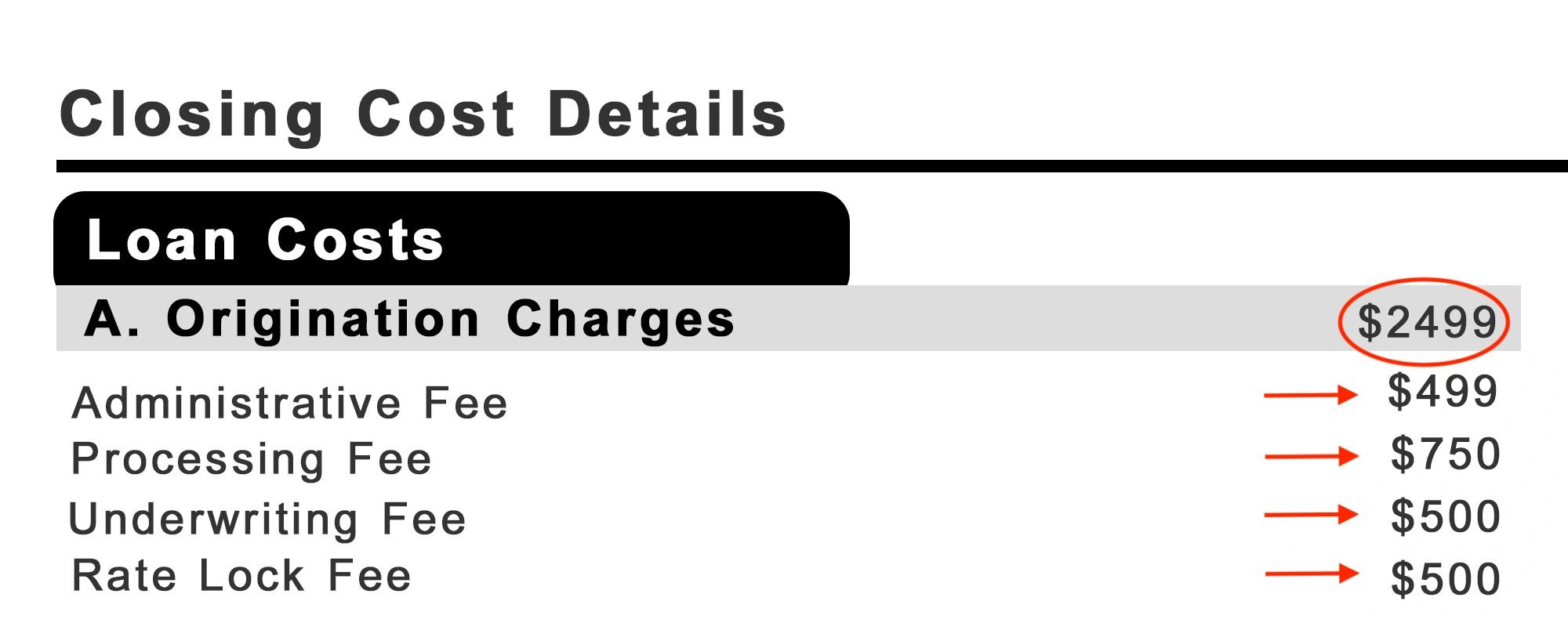

Loan Origination Fee Components, Impact, & Framework

An origination fee is a charge levied by lenders to process a new loan application, and is typically expressed as a percentage of the total loan. What is an origination fee on a loan? Origination fee the _____ is the additional costs you pay each. A fee that is charged by a lender to make up for the cost that.

Loan Origination Fee Definition Real Estate License Wizard

A percentage of the loan that is charged to cover the cost of giving the loan is known as _____. Origination fee the _____ is the additional costs you pay each. What is an origination fee on a loan? How often do you need to. Study with quizlet and memorize flashcards containing terms like when dealing with loan origination fees,.

FHA Guidelines, Requirements & Mortgage Checklist FHA Loan Search

A fee that is charged by a lender to make up for the cost that they spend giving you a loan. What is an origination fee on a loan? An origination fee is a charge levied by lenders to process a new loan application, and is typically expressed as a percentage of the total loan. A percentage of the loan.

What Is A Personal Loan Origination Fee? Wealthy Millionaire

An origination fee is a charge levied by lenders to process a new loan application, and is typically expressed as a percentage of the total loan. A fee that is charged by a lender to make up for the cost that they spend giving you a loan. Origination fee the _____ is the additional costs you pay each. A percentage.

Free of Charge Creative Commons loan origination fee Image Real Estate 3

Origination fee the _____ is the additional costs you pay each. A fee that is charged by a lender to make up for the cost that they spend giving you a loan. What is an origination fee on a loan? How often do you need to. A percentage of the loan that is charged to cover the cost of giving.

Free of Charge Creative Commons loan origination fee Image Real Estate 2

A fee that is charged by a lender to make up for the cost that they spend giving you a loan. A percentage of the loan that is charged to cover the cost of giving the loan is known as _____. An origination fee is a charge levied by lenders to process a new loan application, and is typically expressed.

What Are Car Loan Origination Fees? [And 5 Ways To Minimize Their Cost]

What is an origination fee on a loan? Study with quizlet and memorize flashcards containing terms like when dealing with loan origination fees, one point is equal to, what is. Origination fee the _____ is the additional costs you pay each. A fee that is charged by a lender to make up for the cost that they spend giving you.

A Percentage Of The Loan That Is Charged To Cover The Cost Of Giving The Loan Is Known As _____.

An origination fee is a charge levied by lenders to process a new loan application, and is typically expressed as a percentage of the total loan. What is an origination fee on a loan? Origination fee the _____ is the additional costs you pay each. A fee that is charged by a lender to make up for the cost that they spend giving you a loan.

How Often Do You Need To.

Study with quizlet and memorize flashcards containing terms like when dealing with loan origination fees, one point is equal to, what is.

![What Are Car Loan Origination Fees? [And 5 Ways To Minimize Their Cost]](https://blog.way.com/wp-content/uploads/2022/05/Loan-Origination-fee-1024x682.jpg)