What Is The 8832 Form For Llc

What Is The 8832 Form For Llc - Pursuant to the entity classification rules, a. Specifically, a domestic llc with at least two members is classified as a partnership for federal income tax purposes unless it files form. Form 8832 is the entity classification election form from the irs. Information about form 8832, entity. It is filed to elect a tax status other than the default status for your entity. Llcs can file form 8832, entity classification election to elect their business entity classification. Form 8832 is used by eligible entities to choose how they are classified for federal tax purposes.

Pursuant to the entity classification rules, a. Form 8832 is the entity classification election form from the irs. Specifically, a domestic llc with at least two members is classified as a partnership for federal income tax purposes unless it files form. Llcs can file form 8832, entity classification election to elect their business entity classification. Information about form 8832, entity. It is filed to elect a tax status other than the default status for your entity. Form 8832 is used by eligible entities to choose how they are classified for federal tax purposes.

Pursuant to the entity classification rules, a. It is filed to elect a tax status other than the default status for your entity. Form 8832 is the entity classification election form from the irs. Information about form 8832, entity. Form 8832 is used by eligible entities to choose how they are classified for federal tax purposes. Llcs can file form 8832, entity classification election to elect their business entity classification. Specifically, a domestic llc with at least two members is classified as a partnership for federal income tax purposes unless it files form.

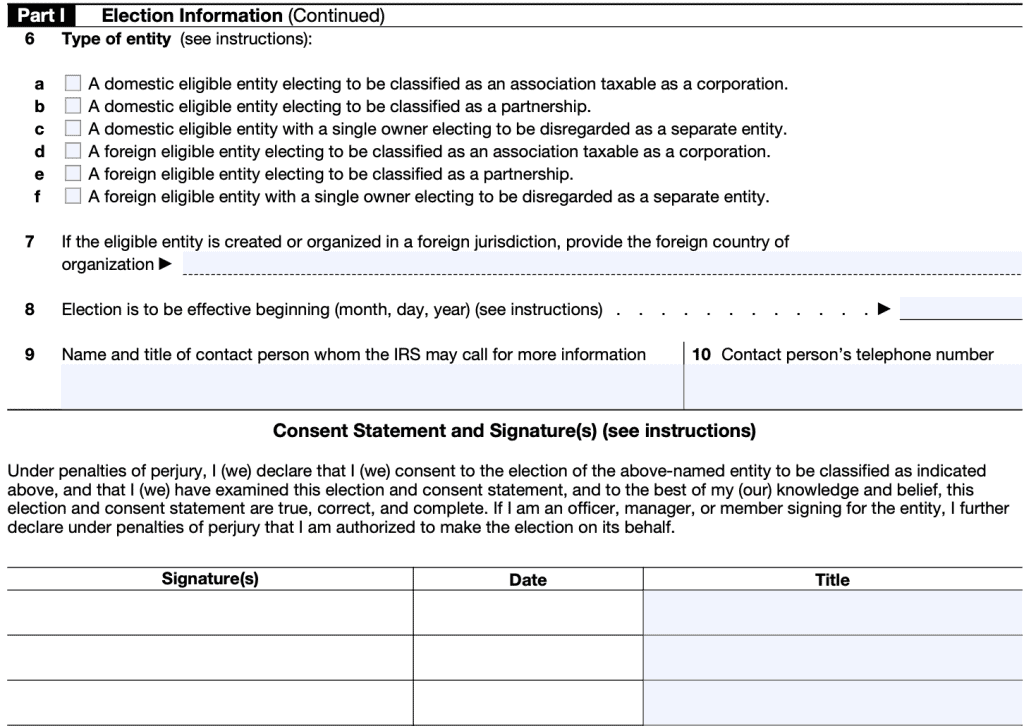

What is Form 8832?

Pursuant to the entity classification rules, a. Form 8832 is used by eligible entities to choose how they are classified for federal tax purposes. It is filed to elect a tax status other than the default status for your entity. Specifically, a domestic llc with at least two members is classified as a partnership for federal income tax purposes unless.

IRS Form 8832 Instructions Entity Classification Election

Llcs can file form 8832, entity classification election to elect their business entity classification. Information about form 8832, entity. Pursuant to the entity classification rules, a. Form 8832 is used by eligible entities to choose how they are classified for federal tax purposes. Form 8832 is the entity classification election form from the irs.

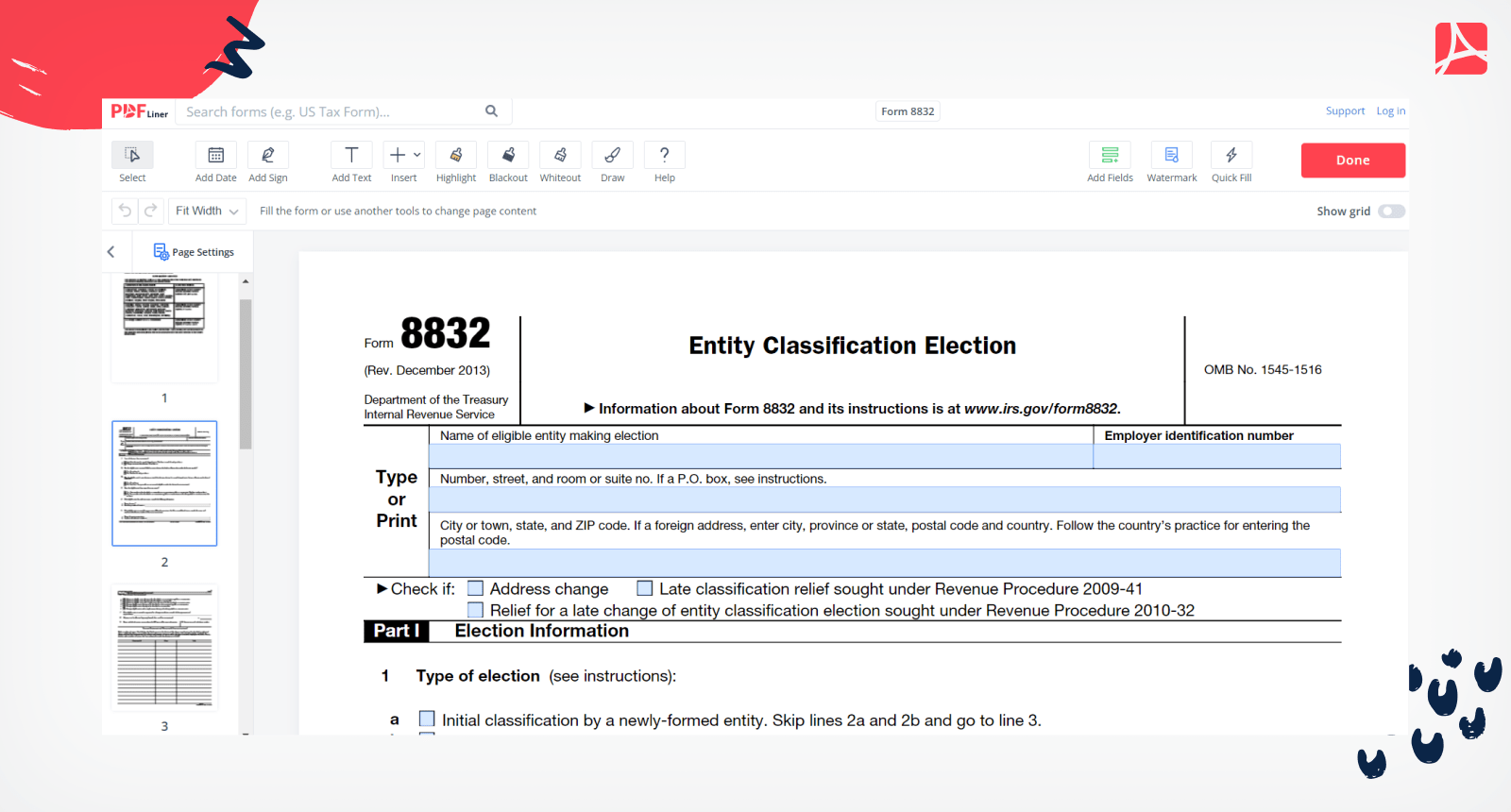

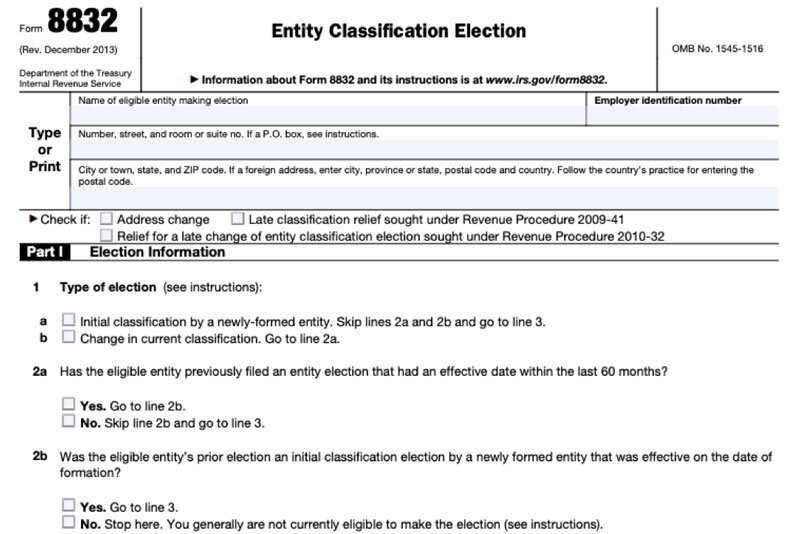

Form 8832 Fillable and Printable blank PDFline

Specifically, a domestic llc with at least two members is classified as a partnership for federal income tax purposes unless it files form. Llcs can file form 8832, entity classification election to elect their business entity classification. Pursuant to the entity classification rules, a. Form 8832 is used by eligible entities to choose how they are classified for federal tax.

Form 8832 All About It and How to File It?

Form 8832 is used by eligible entities to choose how they are classified for federal tax purposes. Pursuant to the entity classification rules, a. Form 8832 is the entity classification election form from the irs. Specifically, a domestic llc with at least two members is classified as a partnership for federal income tax purposes unless it files form. Llcs can.

Do I Need to File IRS Form 8832 for My Business? The Handy Tax Guy

Specifically, a domestic llc with at least two members is classified as a partnership for federal income tax purposes unless it files form. Form 8832 is used by eligible entities to choose how they are classified for federal tax purposes. It is filed to elect a tax status other than the default status for your entity. Form 8832 is the.

Form 8832 and Changing Your LLC Tax Status Accracy Blog

Specifically, a domestic llc with at least two members is classified as a partnership for federal income tax purposes unless it files form. Information about form 8832, entity. It is filed to elect a tax status other than the default status for your entity. Llcs can file form 8832, entity classification election to elect their business entity classification. Form 8832.

Form 8832 All About It and How to File It?

Specifically, a domestic llc with at least two members is classified as a partnership for federal income tax purposes unless it files form. Information about form 8832, entity. Form 8832 is used by eligible entities to choose how they are classified for federal tax purposes. Pursuant to the entity classification rules, a. It is filed to elect a tax status.

What is Form 8832? An Essential Guide for Small Business Owners The

It is filed to elect a tax status other than the default status for your entity. Pursuant to the entity classification rules, a. Form 8832 is used by eligible entities to choose how they are classified for federal tax purposes. Specifically, a domestic llc with at least two members is classified as a partnership for federal income tax purposes unless.

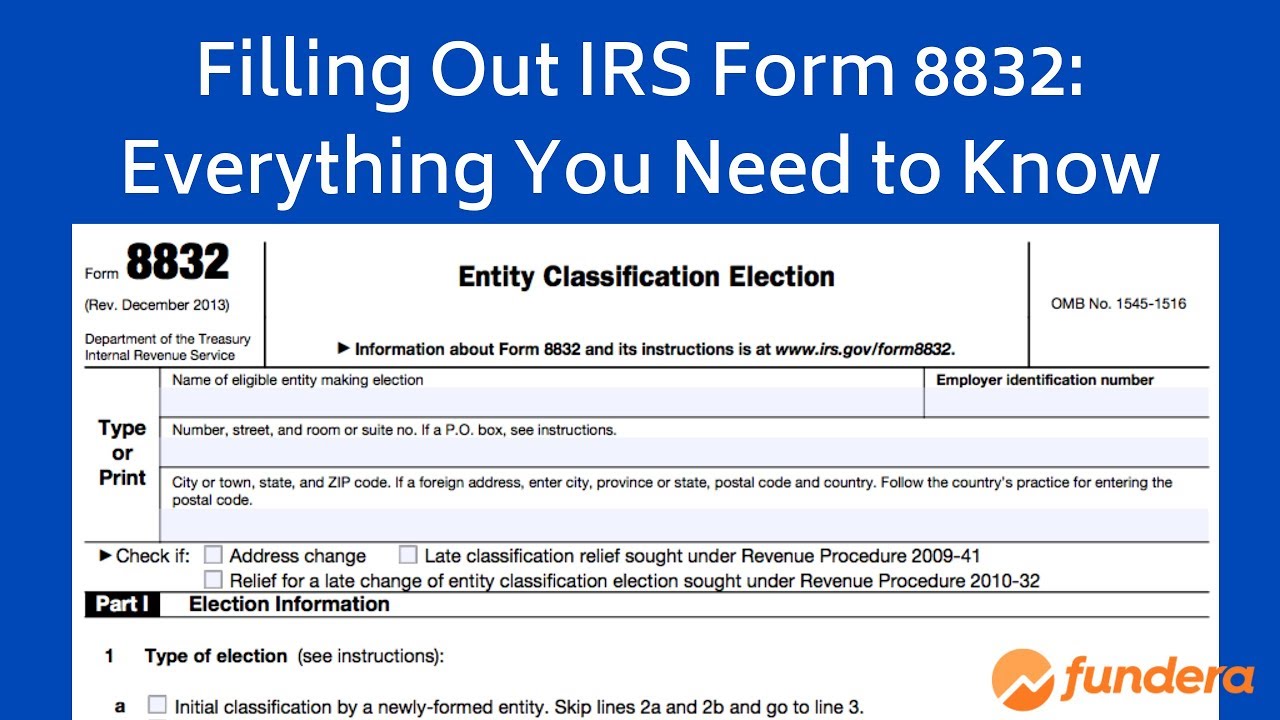

Filling out IRS Form 8832 An EasytoFollow Guide YouTube

Pursuant to the entity classification rules, a. Llcs can file form 8832, entity classification election to elect their business entity classification. It is filed to elect a tax status other than the default status for your entity. Form 8832 is used by eligible entities to choose how they are classified for federal tax purposes. Specifically, a domestic llc with at.

What Is IRS Form 8832?

Form 8832 is the entity classification election form from the irs. Llcs can file form 8832, entity classification election to elect their business entity classification. It is filed to elect a tax status other than the default status for your entity. Specifically, a domestic llc with at least two members is classified as a partnership for federal income tax purposes.

Form 8832 Is The Entity Classification Election Form From The Irs.

Llcs can file form 8832, entity classification election to elect their business entity classification. Pursuant to the entity classification rules, a. Information about form 8832, entity. Form 8832 is used by eligible entities to choose how they are classified for federal tax purposes.

It Is Filed To Elect A Tax Status Other Than The Default Status For Your Entity.

Specifically, a domestic llc with at least two members is classified as a partnership for federal income tax purposes unless it files form.