What Is The Sales Tax Rate In Hillsborough County Florida

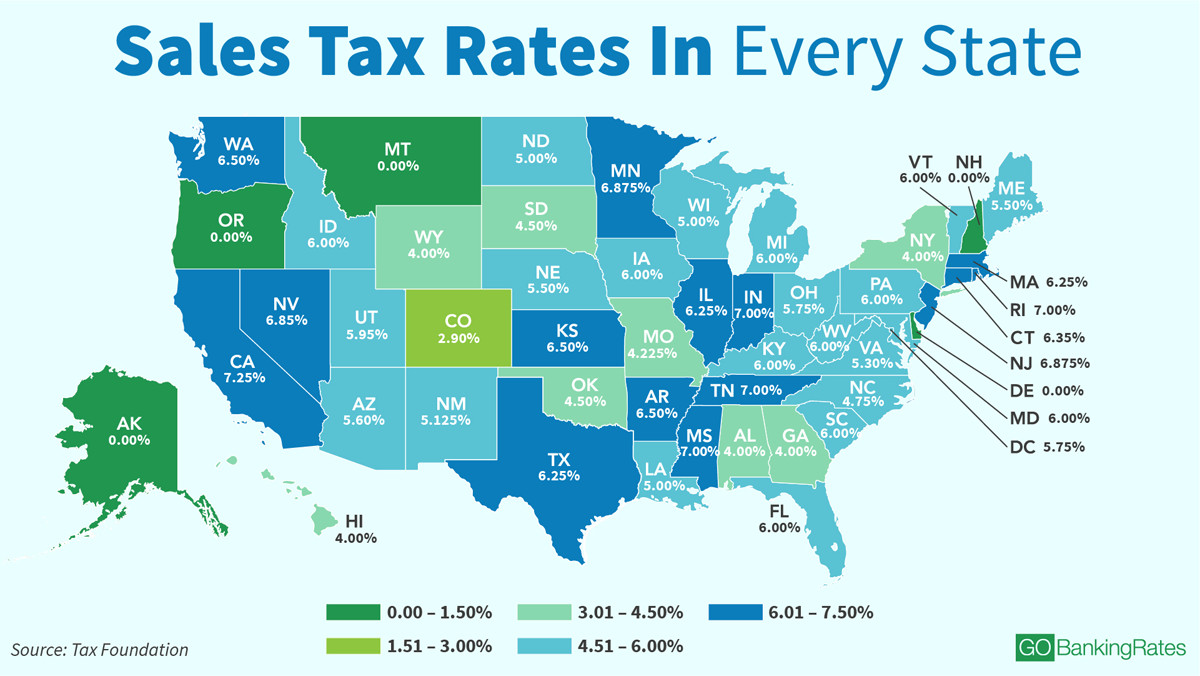

What Is The Sales Tax Rate In Hillsborough County Florida - There is no applicable city tax or. The hillsborough county sales tax rate is 1.5%. 730 rows florida has state sales tax of 6%, and allows local governments to collect a local option sales tax of up to 1.5%. Click for sales tax rates, hillsborough county sales tax calculator, and printable sales. Look up the current rate for a specific address using the same geolocation technology that powers the. Hillsborough county residents currently pay a 1.5% discretionary sales surtax on the first $5,000 of taxable value. The current sales tax rate in hillsborough county, fl is 7.5%. The 7.5% sales tax rate in tampa consists of 6% florida state sales tax and 1.5% hillsborough county sales tax. Florida sales and use tax in the. There are a total of 362.

Look up the current rate for a specific address using the same geolocation technology that powers the. There is no applicable city tax or. Click for sales tax rates, hillsborough county sales tax calculator, and printable sales. Hillsborough county residents currently pay a 1.5% discretionary sales surtax on the first $5,000 of taxable value. The 7.5% sales tax rate in tampa consists of 6% florida state sales tax and 1.5% hillsborough county sales tax. There are a total of 362. 730 rows florida has state sales tax of 6%, and allows local governments to collect a local option sales tax of up to 1.5%. Florida sales and use tax in the. The hillsborough county sales tax rate is 1.5%. The current sales tax rate in hillsborough county, fl is 7.5%.

Look up the current rate for a specific address using the same geolocation technology that powers the. The hillsborough county sales tax rate is 1.5%. There are a total of 362. 730 rows florida has state sales tax of 6%, and allows local governments to collect a local option sales tax of up to 1.5%. Hillsborough county residents currently pay a 1.5% discretionary sales surtax on the first $5,000 of taxable value. Florida sales and use tax in the. The 7.5% sales tax rate in tampa consists of 6% florida state sales tax and 1.5% hillsborough county sales tax. There is no applicable city tax or. Click for sales tax rates, hillsborough county sales tax calculator, and printable sales. The current sales tax rate in hillsborough county, fl is 7.5%.

Florida Sales Tax By County 2024 Cele Meggie

The 7.5% sales tax rate in tampa consists of 6% florida state sales tax and 1.5% hillsborough county sales tax. The current sales tax rate in hillsborough county, fl is 7.5%. There is no applicable city tax or. The hillsborough county sales tax rate is 1.5%. Look up the current rate for a specific address using the same geolocation technology.

The Hillsborough County, Florida Local Sales Tax Rate is a minimum of 7.5

Florida sales and use tax in the. There is no applicable city tax or. Hillsborough county residents currently pay a 1.5% discretionary sales surtax on the first $5,000 of taxable value. There are a total of 362. Click for sales tax rates, hillsborough county sales tax calculator, and printable sales.

Ramsey Solutions (RamseySolutions) on Flipboard

The current sales tax rate in hillsborough county, fl is 7.5%. There is no applicable city tax or. Look up the current rate for a specific address using the same geolocation technology that powers the. There are a total of 362. Hillsborough county residents currently pay a 1.5% discretionary sales surtax on the first $5,000 of taxable value.

Hillsborough County Commercial Lease Sales Tax Rate Reduced by Recent

Hillsborough county residents currently pay a 1.5% discretionary sales surtax on the first $5,000 of taxable value. There are a total of 362. Look up the current rate for a specific address using the same geolocation technology that powers the. Florida sales and use tax in the. The hillsborough county sales tax rate is 1.5%.

Florida Property Tax Increase 2024 Janel

There is no applicable city tax or. Florida sales and use tax in the. Click for sales tax rates, hillsborough county sales tax calculator, and printable sales. The 7.5% sales tax rate in tampa consists of 6% florida state sales tax and 1.5% hillsborough county sales tax. Look up the current rate for a specific address using the same geolocation.

Hillsborough County Sales Tax 2024 Milli Suzanne

The current sales tax rate in hillsborough county, fl is 7.5%. The 7.5% sales tax rate in tampa consists of 6% florida state sales tax and 1.5% hillsborough county sales tax. The hillsborough county sales tax rate is 1.5%. There are a total of 362. Florida sales and use tax in the.

Hillsborough County Sales Tax Rates US iCalculator™

There are a total of 362. Hillsborough county residents currently pay a 1.5% discretionary sales surtax on the first $5,000 of taxable value. The current sales tax rate in hillsborough county, fl is 7.5%. The hillsborough county sales tax rate is 1.5%. 730 rows florida has state sales tax of 6%, and allows local governments to collect a local option.

Florida Sales Tax Free Days 2024 Idell Lavinia

Click for sales tax rates, hillsborough county sales tax calculator, and printable sales. The hillsborough county sales tax rate is 1.5%. There is no applicable city tax or. The 7.5% sales tax rate in tampa consists of 6% florida state sales tax and 1.5% hillsborough county sales tax. Look up the current rate for a specific address using the same.

What Is Florida's Sales Tax 2024 Brinna Donella

The current sales tax rate in hillsborough county, fl is 7.5%. The 7.5% sales tax rate in tampa consists of 6% florida state sales tax and 1.5% hillsborough county sales tax. There is no applicable city tax or. Hillsborough county residents currently pay a 1.5% discretionary sales surtax on the first $5,000 of taxable value. Florida sales and use tax.

Hillsborough County Tax Rate 2024 Ajay Lorrie

Florida sales and use tax in the. There are a total of 362. 730 rows florida has state sales tax of 6%, and allows local governments to collect a local option sales tax of up to 1.5%. The current sales tax rate in hillsborough county, fl is 7.5%. The 7.5% sales tax rate in tampa consists of 6% florida state.

Click For Sales Tax Rates, Hillsborough County Sales Tax Calculator, And Printable Sales.

Hillsborough county residents currently pay a 1.5% discretionary sales surtax on the first $5,000 of taxable value. The hillsborough county sales tax rate is 1.5%. There are a total of 362. Florida sales and use tax in the.

There Is No Applicable City Tax Or.

The current sales tax rate in hillsborough county, fl is 7.5%. The 7.5% sales tax rate in tampa consists of 6% florida state sales tax and 1.5% hillsborough county sales tax. 730 rows florida has state sales tax of 6%, and allows local governments to collect a local option sales tax of up to 1.5%. Look up the current rate for a specific address using the same geolocation technology that powers the.