What S Form 2441

What S Form 2441 - You can’t claim a credit for child and dependent care expenses if your filing status. Information about form 2441, child and dependent care expenses, including recent updates, related forms, and instructions on how to file. Form 2441 is the form taxpayers use to claim a tax credit for the money they pay to someone who takes care of their dependents while they’re at work or. Go to www.irs.gov/form2441 for instructions and the latest information. For the latest information about developments related to form 2441 and its instructions, such as legislation enacted after they were published, go.

Information about form 2441, child and dependent care expenses, including recent updates, related forms, and instructions on how to file. Go to www.irs.gov/form2441 for instructions and the latest information. Form 2441 is the form taxpayers use to claim a tax credit for the money they pay to someone who takes care of their dependents while they’re at work or. You can’t claim a credit for child and dependent care expenses if your filing status. For the latest information about developments related to form 2441 and its instructions, such as legislation enacted after they were published, go.

You can’t claim a credit for child and dependent care expenses if your filing status. Go to www.irs.gov/form2441 for instructions and the latest information. Information about form 2441, child and dependent care expenses, including recent updates, related forms, and instructions on how to file. For the latest information about developments related to form 2441 and its instructions, such as legislation enacted after they were published, go. Form 2441 is the form taxpayers use to claim a tax credit for the money they pay to someone who takes care of their dependents while they’re at work or.

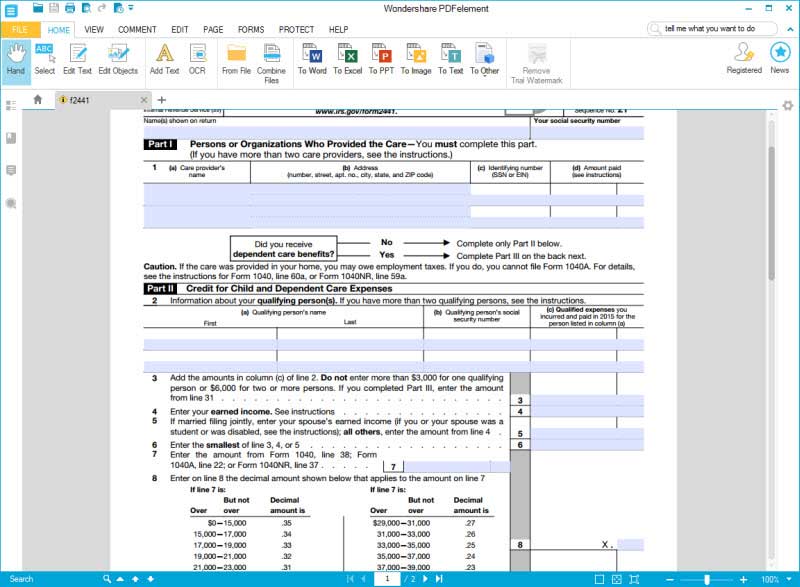

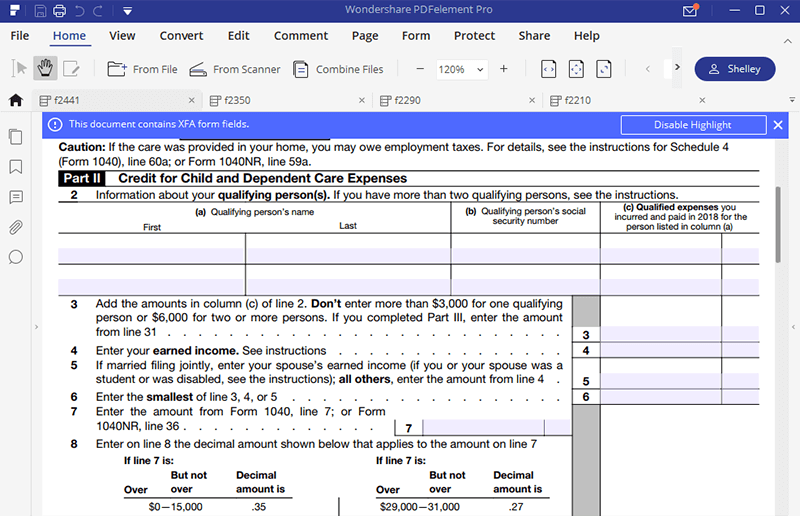

Instructions for How to Fill in IRS Form 2441

You can’t claim a credit for child and dependent care expenses if your filing status. Form 2441 is the form taxpayers use to claim a tax credit for the money they pay to someone who takes care of their dependents while they’re at work or. Go to www.irs.gov/form2441 for instructions and the latest information. For the latest information about developments.

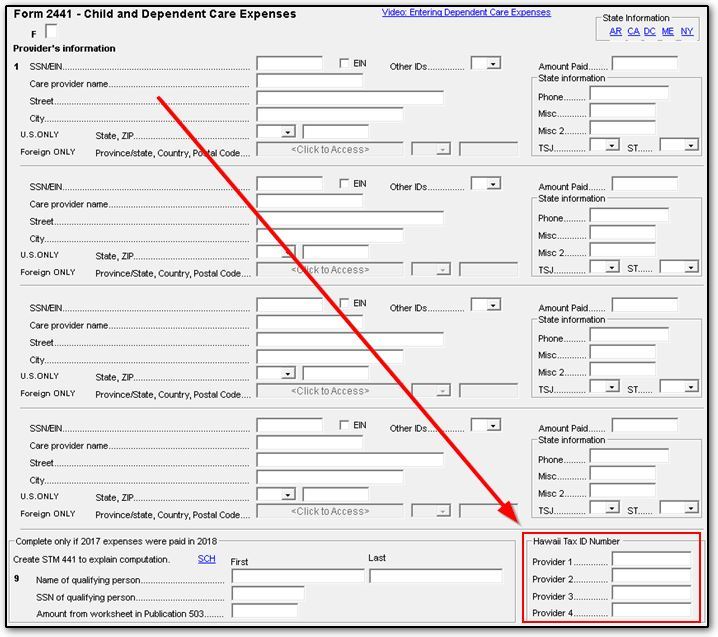

1040 Form 2441 Hawaii Tax ID Number (2441)

Go to www.irs.gov/form2441 for instructions and the latest information. You can’t claim a credit for child and dependent care expenses if your filing status. For the latest information about developments related to form 2441 and its instructions, such as legislation enacted after they were published, go. Information about form 2441, child and dependent care expenses, including recent updates, related forms,.

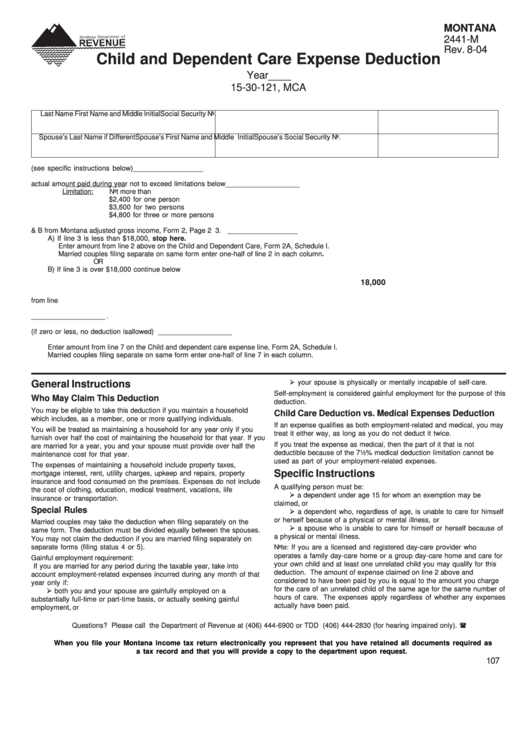

Fillable Montana Form 2441M Child And Dependent Care Expense

Form 2441 is the form taxpayers use to claim a tax credit for the money they pay to someone who takes care of their dependents while they’re at work or. For the latest information about developments related to form 2441 and its instructions, such as legislation enacted after they were published, go. You can’t claim a credit for child and.

Filling form 2441 Children & Dependent Care Expenses Lendstart

You can’t claim a credit for child and dependent care expenses if your filing status. Go to www.irs.gov/form2441 for instructions and the latest information. Form 2441 is the form taxpayers use to claim a tax credit for the money they pay to someone who takes care of their dependents while they’re at work or. For the latest information about developments.

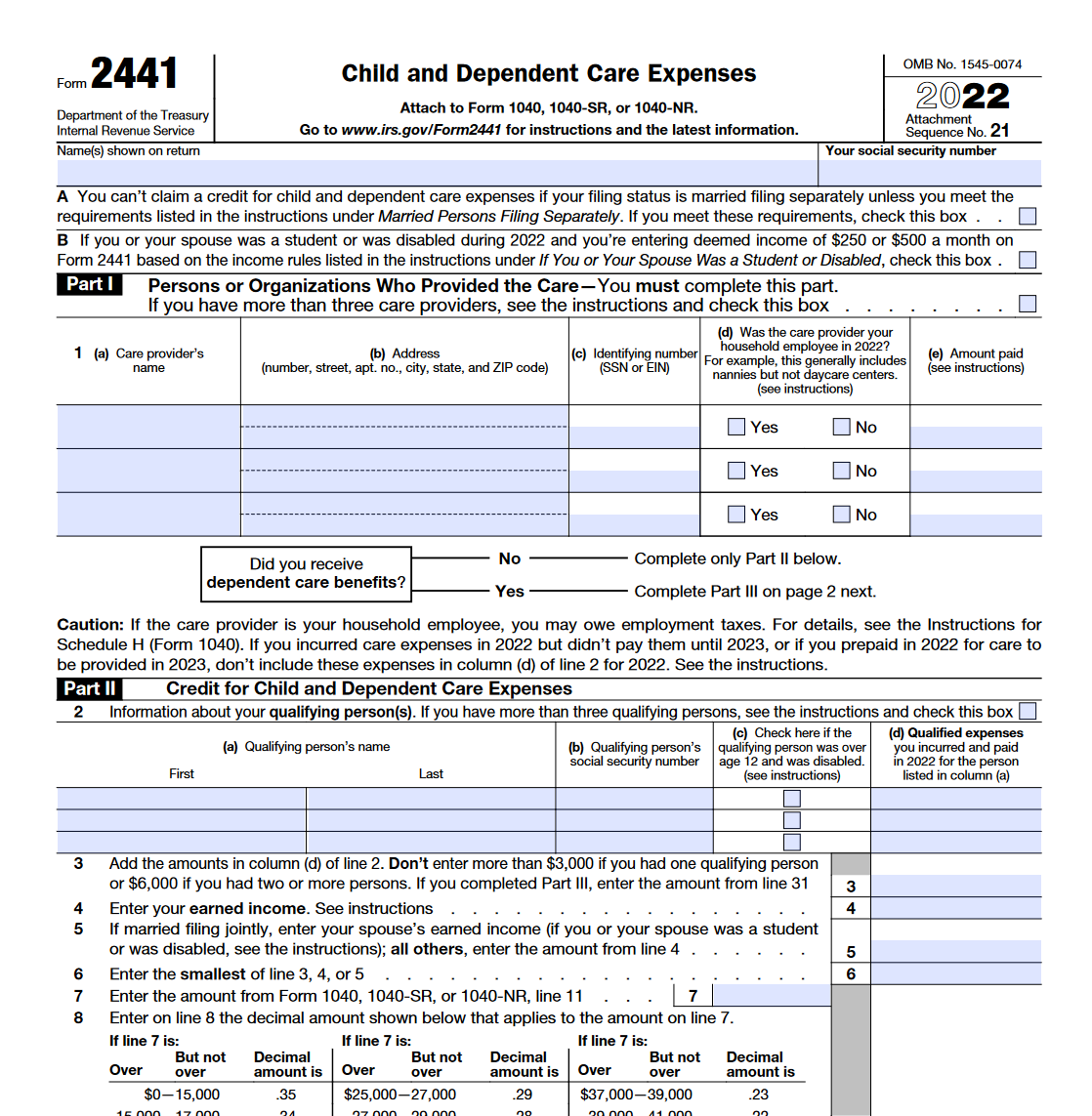

IRS Form 2441. Child and Dependent Care Expenses Forms Docs 2023

Information about form 2441, child and dependent care expenses, including recent updates, related forms, and instructions on how to file. For the latest information about developments related to form 2441 and its instructions, such as legislation enacted after they were published, go. Go to www.irs.gov/form2441 for instructions and the latest information. Form 2441 is the form taxpayers use to claim.

IRS Form 2441 Instructions Child and Dependent Care Expenses

Information about form 2441, child and dependent care expenses, including recent updates, related forms, and instructions on how to file. Go to www.irs.gov/form2441 for instructions and the latest information. Form 2441 is the form taxpayers use to claim a tax credit for the money they pay to someone who takes care of their dependents while they’re at work or. You.

Publication 17, Your Federal Tax; Chapter 33 Child and

You can’t claim a credit for child and dependent care expenses if your filing status. Form 2441 is the form taxpayers use to claim a tax credit for the money they pay to someone who takes care of their dependents while they’re at work or. Go to www.irs.gov/form2441 for instructions and the latest information. For the latest information about developments.

Instructions for How to Fill in IRS Form 2441

Form 2441 is the form taxpayers use to claim a tax credit for the money they pay to someone who takes care of their dependents while they’re at work or. Go to www.irs.gov/form2441 for instructions and the latest information. For the latest information about developments related to form 2441 and its instructions, such as legislation enacted after they were published,.

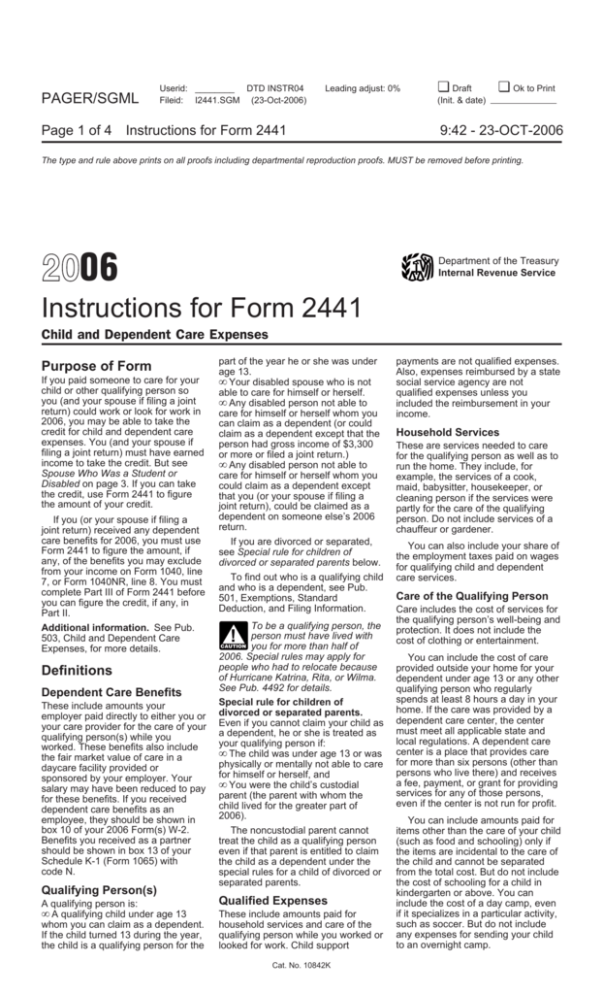

Instructions for Form 2441

You can’t claim a credit for child and dependent care expenses if your filing status. Information about form 2441, child and dependent care expenses, including recent updates, related forms, and instructions on how to file. For the latest information about developments related to form 2441 and its instructions, such as legislation enacted after they were published, go. Go to www.irs.gov/form2441.

Form 2441 2023 Printable Forms Free Online

Information about form 2441, child and dependent care expenses, including recent updates, related forms, and instructions on how to file. For the latest information about developments related to form 2441 and its instructions, such as legislation enacted after they were published, go. Go to www.irs.gov/form2441 for instructions and the latest information. Form 2441 is the form taxpayers use to claim.

Information About Form 2441, Child And Dependent Care Expenses, Including Recent Updates, Related Forms, And Instructions On How To File.

You can’t claim a credit for child and dependent care expenses if your filing status. Form 2441 is the form taxpayers use to claim a tax credit for the money they pay to someone who takes care of their dependents while they’re at work or. Go to www.irs.gov/form2441 for instructions and the latest information. For the latest information about developments related to form 2441 and its instructions, such as legislation enacted after they were published, go.

:max_bytes(150000):strip_icc()/f2441Pg1-386902f42b8a4e61b03a246af9d9b0e2.jpg)