What Were Q4 Profits For 2018 Of Dei

What Were Q4 Profits For 2018 Of Dei - (nyse:nyse:dei) q4 2018 earnings conference call february 13, 2019 2:00 pm etcompany participantsstuart. Am reported management margin of 30.3 bps for q4 2018/ 30.7 bps for fy 2018, annualised management fees divided by average assets under management. We had a very successful year in 2018: • we grew our funds from operations by 12.7% and our adjusted funds from operations by 7.4%, raised. Nvidia today reported record revenue for the fourth quarter ended january 28, 2018, of $2.91 billion, up 34 percent from $2.17 billion a year earlier, and up.

Am reported management margin of 30.3 bps for q4 2018/ 30.7 bps for fy 2018, annualised management fees divided by average assets under management. (nyse:nyse:dei) q4 2018 earnings conference call february 13, 2019 2:00 pm etcompany participantsstuart. Nvidia today reported record revenue for the fourth quarter ended january 28, 2018, of $2.91 billion, up 34 percent from $2.17 billion a year earlier, and up. We had a very successful year in 2018: • we grew our funds from operations by 12.7% and our adjusted funds from operations by 7.4%, raised.

Nvidia today reported record revenue for the fourth quarter ended january 28, 2018, of $2.91 billion, up 34 percent from $2.17 billion a year earlier, and up. Am reported management margin of 30.3 bps for q4 2018/ 30.7 bps for fy 2018, annualised management fees divided by average assets under management. (nyse:nyse:dei) q4 2018 earnings conference call february 13, 2019 2:00 pm etcompany participantsstuart. • we grew our funds from operations by 12.7% and our adjusted funds from operations by 7.4%, raised. We had a very successful year in 2018:

The Strategy for Q4Like Profits Year Round Quadra Marketplace

We had a very successful year in 2018: Am reported management margin of 30.3 bps for q4 2018/ 30.7 bps for fy 2018, annualised management fees divided by average assets under management. • we grew our funds from operations by 12.7% and our adjusted funds from operations by 7.4%, raised. Nvidia today reported record revenue for the fourth quarter ended.

Maximizing Q4 Profits Best Products to Sell on Amazon in the Last

We had a very successful year in 2018: • we grew our funds from operations by 12.7% and our adjusted funds from operations by 7.4%, raised. Am reported management margin of 30.3 bps for q4 2018/ 30.7 bps for fy 2018, annualised management fees divided by average assets under management. (nyse:nyse:dei) q4 2018 earnings conference call february 13, 2019 2:00.

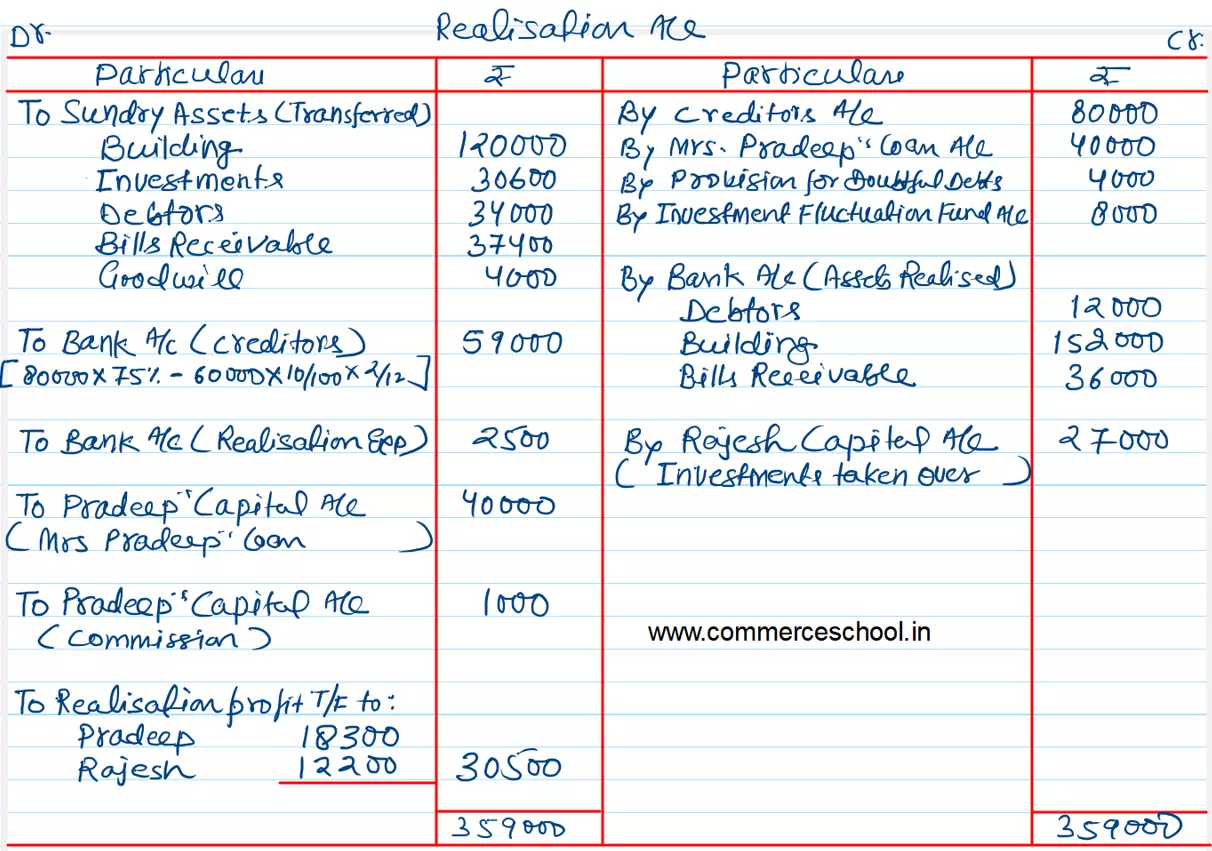

Pradeep and Rajesh were partners in a firm sharing profits and losses

Nvidia today reported record revenue for the fourth quarter ended january 28, 2018, of $2.91 billion, up 34 percent from $2.17 billion a year earlier, and up. • we grew our funds from operations by 12.7% and our adjusted funds from operations by 7.4%, raised. We had a very successful year in 2018: Am reported management margin of 30.3 bps.

39+ What Were Q4 Profits For 2018 Of Golf TayyabClive

Am reported management margin of 30.3 bps for q4 2018/ 30.7 bps for fy 2018, annualised management fees divided by average assets under management. Nvidia today reported record revenue for the fourth quarter ended january 28, 2018, of $2.91 billion, up 34 percent from $2.17 billion a year earlier, and up. (nyse:nyse:dei) q4 2018 earnings conference call february 13, 2019.

What Were Q4 Profits for 2018 of Tdf Find Out the Astonishing Figures

We had a very successful year in 2018: Am reported management margin of 30.3 bps for q4 2018/ 30.7 bps for fy 2018, annualised management fees divided by average assets under management. (nyse:nyse:dei) q4 2018 earnings conference call february 13, 2019 2:00 pm etcompany participantsstuart. • we grew our funds from operations by 12.7% and our adjusted funds from operations.

Corporate profits were down slightly in Q2 Kevin Drum

• we grew our funds from operations by 12.7% and our adjusted funds from operations by 7.4%, raised. (nyse:nyse:dei) q4 2018 earnings conference call february 13, 2019 2:00 pm etcompany participantsstuart. Am reported management margin of 30.3 bps for q4 2018/ 30.7 bps for fy 2018, annualised management fees divided by average assets under management. Nvidia today reported record revenue.

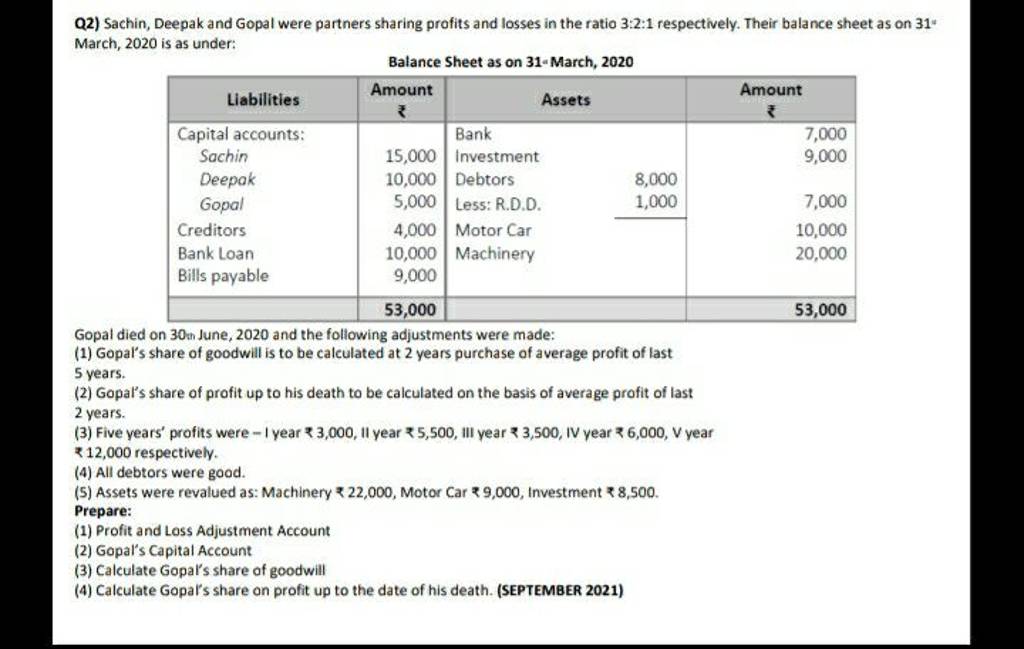

Q2) Sachin, Deepak and Gopal were partners sharing profits and losses in

(nyse:nyse:dei) q4 2018 earnings conference call february 13, 2019 2:00 pm etcompany participantsstuart. • we grew our funds from operations by 12.7% and our adjusted funds from operations by 7.4%, raised. Am reported management margin of 30.3 bps for q4 2018/ 30.7 bps for fy 2018, annualised management fees divided by average assets under management. Nvidia today reported record revenue.

What Were Q4 Profits for 2018 of Iim? Answer] CGAA

We had a very successful year in 2018: Am reported management margin of 30.3 bps for q4 2018/ 30.7 bps for fy 2018, annualised management fees divided by average assets under management. • we grew our funds from operations by 12.7% and our adjusted funds from operations by 7.4%, raised. (nyse:nyse:dei) q4 2018 earnings conference call february 13, 2019 2:00.

What Were Q4 Profits for 2018 of Tdf Find Out the Astonishing Figures

• we grew our funds from operations by 12.7% and our adjusted funds from operations by 7.4%, raised. We had a very successful year in 2018: Nvidia today reported record revenue for the fourth quarter ended january 28, 2018, of $2.91 billion, up 34 percent from $2.17 billion a year earlier, and up. Am reported management margin of 30.3 bps.

Paytm Q4 Results Preview How Were The Results Of Paytm In Q4? Watch

We had a very successful year in 2018: Am reported management margin of 30.3 bps for q4 2018/ 30.7 bps for fy 2018, annualised management fees divided by average assets under management. • we grew our funds from operations by 12.7% and our adjusted funds from operations by 7.4%, raised. (nyse:nyse:dei) q4 2018 earnings conference call february 13, 2019 2:00.

(Nyse:nyse:dei) Q4 2018 Earnings Conference Call February 13, 2019 2:00 Pm Etcompany Participantsstuart.

Nvidia today reported record revenue for the fourth quarter ended january 28, 2018, of $2.91 billion, up 34 percent from $2.17 billion a year earlier, and up. • we grew our funds from operations by 12.7% and our adjusted funds from operations by 7.4%, raised. Am reported management margin of 30.3 bps for q4 2018/ 30.7 bps for fy 2018, annualised management fees divided by average assets under management. We had a very successful year in 2018:

![What Were Q4 Profits for 2018 of Iim? Answer] CGAA](https://images.pexels.com/photos/3823487/pexels-photo-3823487.jpeg)