Where Does Form 2439 Go On Tax Return

Where Does Form 2439 Go On Tax Return - Income tax return for the tax year that includes the last day of the ric’s or reit’s tax year. To enter form 2439 go to investment income and select undistributed capital gains or you can search for form 2439 in the top right. What is this, and how do i report the info on my desktop turbo tax return? Fees for other optional products or product features may apply.

Fees for other optional products or product features may apply. What is this, and how do i report the info on my desktop turbo tax return? Income tax return for the tax year that includes the last day of the ric’s or reit’s tax year. To enter form 2439 go to investment income and select undistributed capital gains or you can search for form 2439 in the top right.

Income tax return for the tax year that includes the last day of the ric’s or reit’s tax year. To enter form 2439 go to investment income and select undistributed capital gains or you can search for form 2439 in the top right. What is this, and how do i report the info on my desktop turbo tax return? Fees for other optional products or product features may apply.

What is Form 2439? Explained Reporting Undistributed LongTerm Capital

What is this, and how do i report the info on my desktop turbo tax return? Fees for other optional products or product features may apply. To enter form 2439 go to investment income and select undistributed capital gains or you can search for form 2439 in the top right. Income tax return for the tax year that includes the.

Irs 2024 Instructions 2024 Pdf Laney Mirella

What is this, and how do i report the info on my desktop turbo tax return? Fees for other optional products or product features may apply. To enter form 2439 go to investment income and select undistributed capital gains or you can search for form 2439 in the top right. Income tax return for the tax year that includes the.

The 2439 Form Explained

Income tax return for the tax year that includes the last day of the ric’s or reit’s tax year. What is this, and how do i report the info on my desktop turbo tax return? To enter form 2439 go to investment income and select undistributed capital gains or you can search for form 2439 in the top right. Fees.

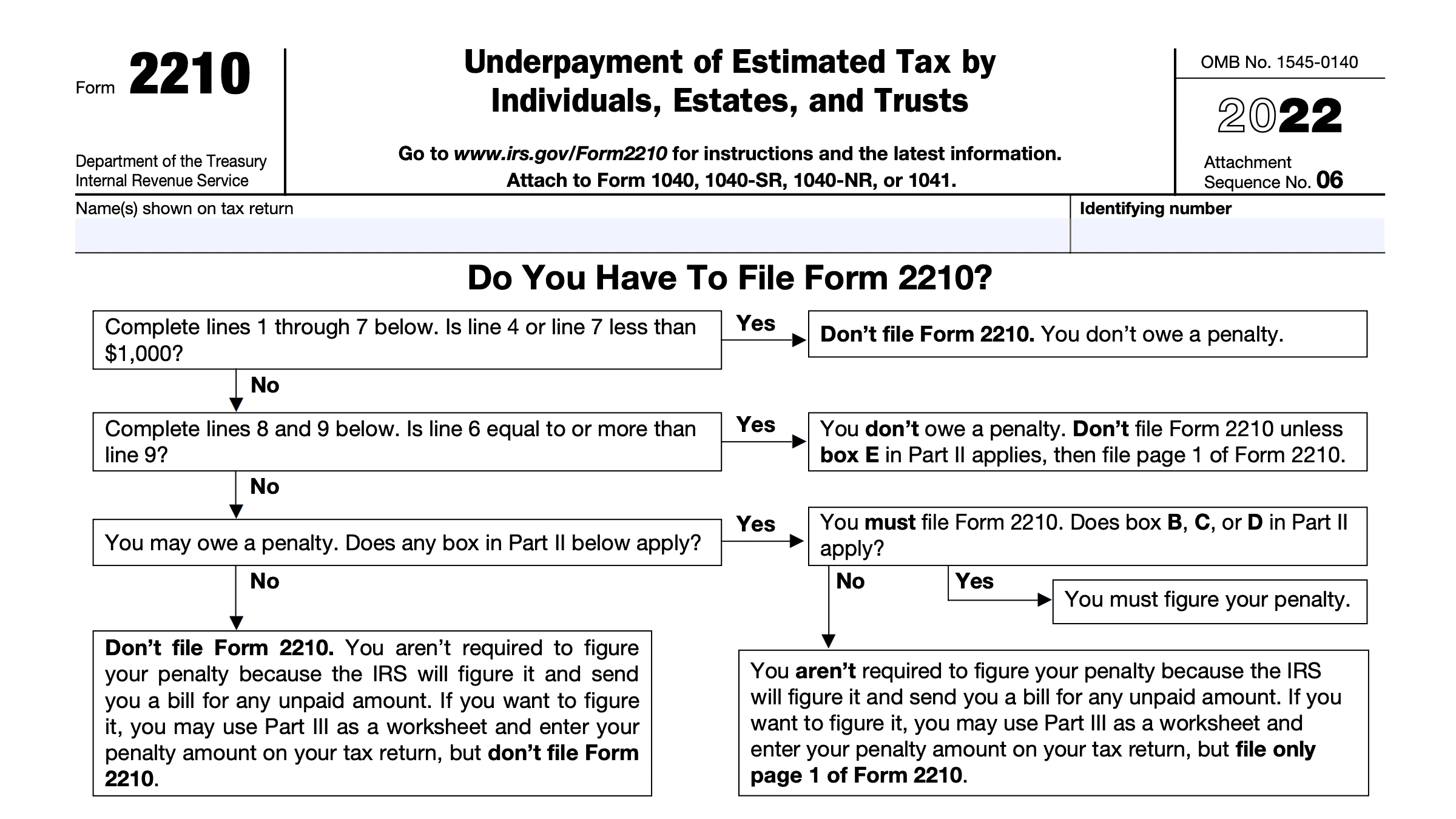

Instructions For 2024 Estimated Tax Worksheet Biddy Rosette

What is this, and how do i report the info on my desktop turbo tax return? Income tax return for the tax year that includes the last day of the ric’s or reit’s tax year. Fees for other optional products or product features may apply. To enter form 2439 go to investment income and select undistributed capital gains or you.

Brief Details on Understanding the 2439 tax form

To enter form 2439 go to investment income and select undistributed capital gains or you can search for form 2439 in the top right. Income tax return for the tax year that includes the last day of the ric’s or reit’s tax year. What is this, and how do i report the info on my desktop turbo tax return? Fees.

Printable Federal Tax Return Form Printable Forms Free Online

Income tax return for the tax year that includes the last day of the ric’s or reit’s tax year. What is this, and how do i report the info on my desktop turbo tax return? Fees for other optional products or product features may apply. To enter form 2439 go to investment income and select undistributed capital gains or you.

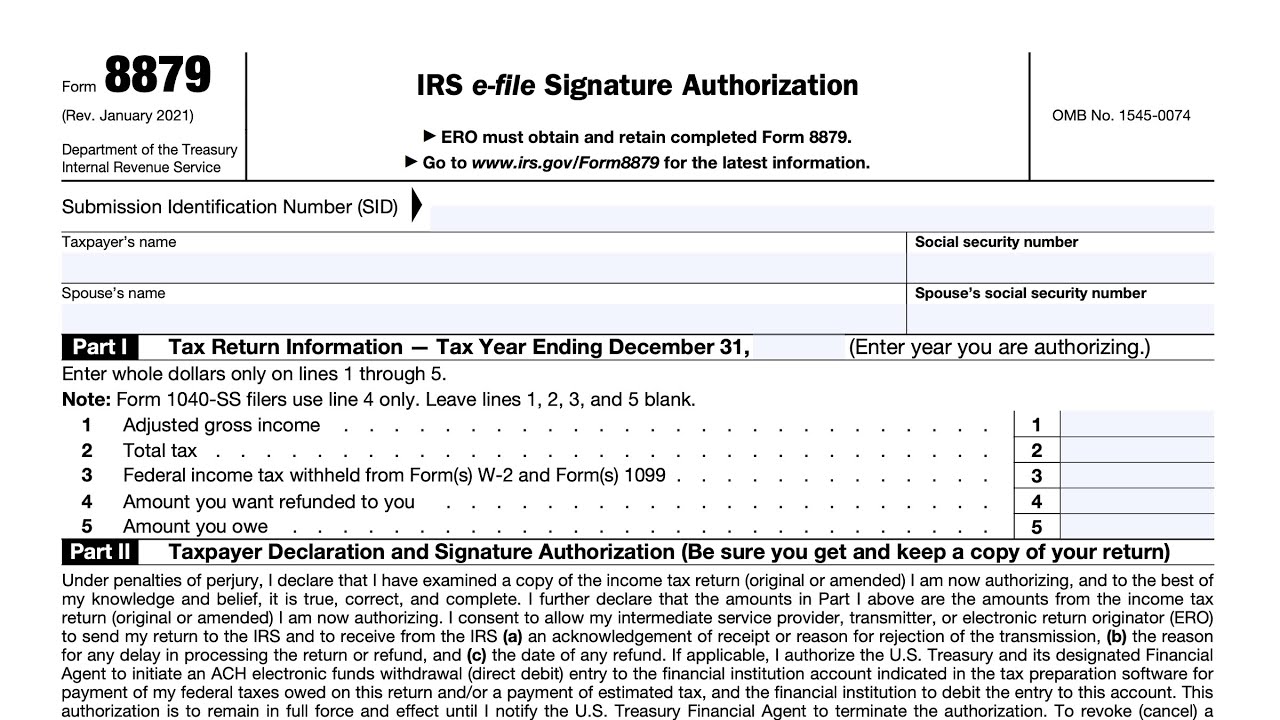

Irs E File Tax Return

What is this, and how do i report the info on my desktop turbo tax return? Income tax return for the tax year that includes the last day of the ric’s or reit’s tax year. Fees for other optional products or product features may apply. To enter form 2439 go to investment income and select undistributed capital gains or you.

Form 2439 Finance Reference

Fees for other optional products or product features may apply. To enter form 2439 go to investment income and select undistributed capital gains or you can search for form 2439 in the top right. Income tax return for the tax year that includes the last day of the ric’s or reit’s tax year. What is this, and how do i.

IRS Form 2439 Instructions Undistributed LongTerm Capital Gains

To enter form 2439 go to investment income and select undistributed capital gains or you can search for form 2439 in the top right. What is this, and how do i report the info on my desktop turbo tax return? Income tax return for the tax year that includes the last day of the ric’s or reit’s tax year. Fees.

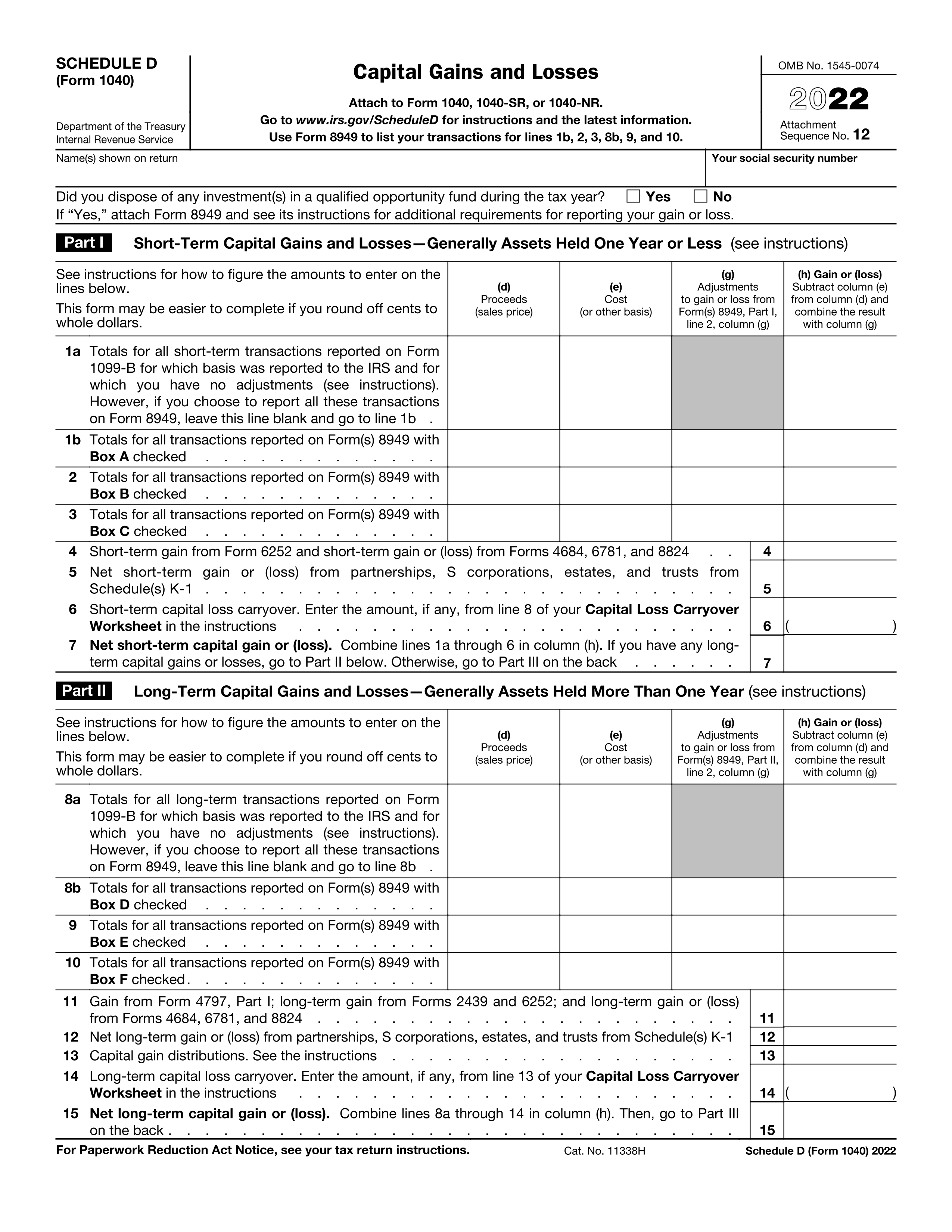

IRS Schedule D

Income tax return for the tax year that includes the last day of the ric’s or reit’s tax year. What is this, and how do i report the info on my desktop turbo tax return? To enter form 2439 go to investment income and select undistributed capital gains or you can search for form 2439 in the top right. Fees.

Fees For Other Optional Products Or Product Features May Apply.

To enter form 2439 go to investment income and select undistributed capital gains or you can search for form 2439 in the top right. Income tax return for the tax year that includes the last day of the ric’s or reit’s tax year. What is this, and how do i report the info on my desktop turbo tax return?

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at9.17.55AM-43bd78fa82bb4fa397892e3e69047cf2.png)