Withholding Tables 2024

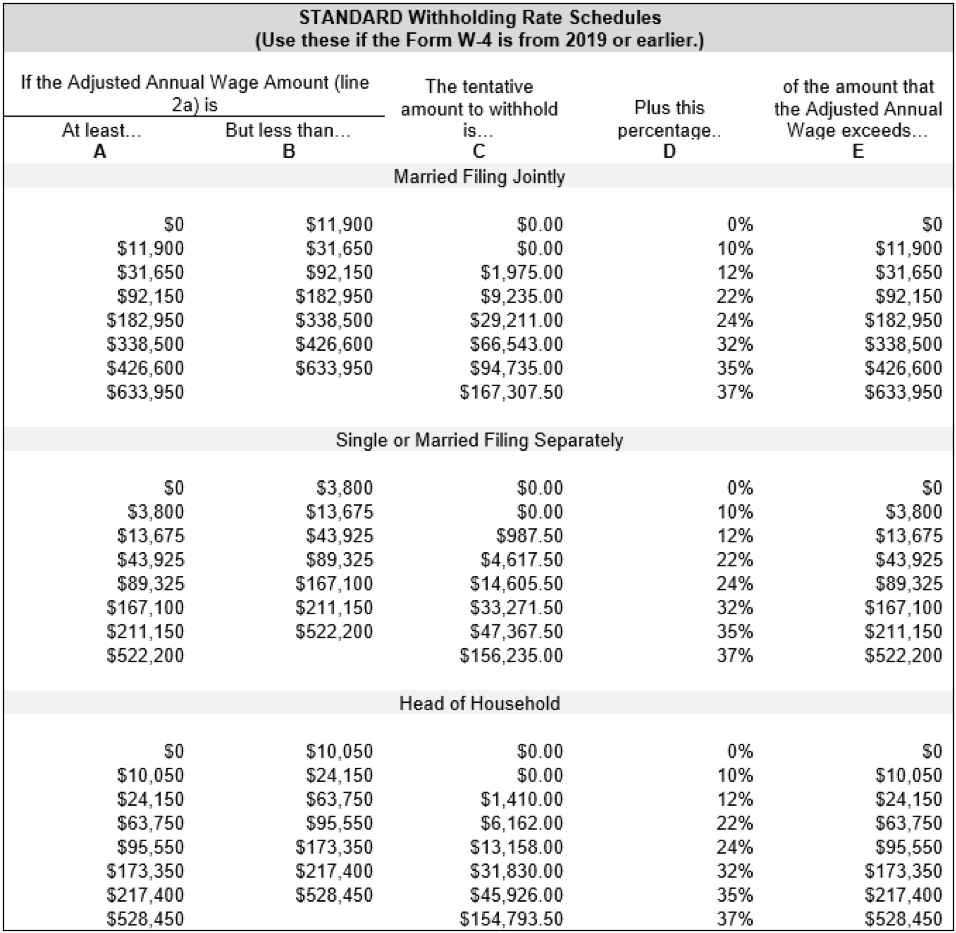

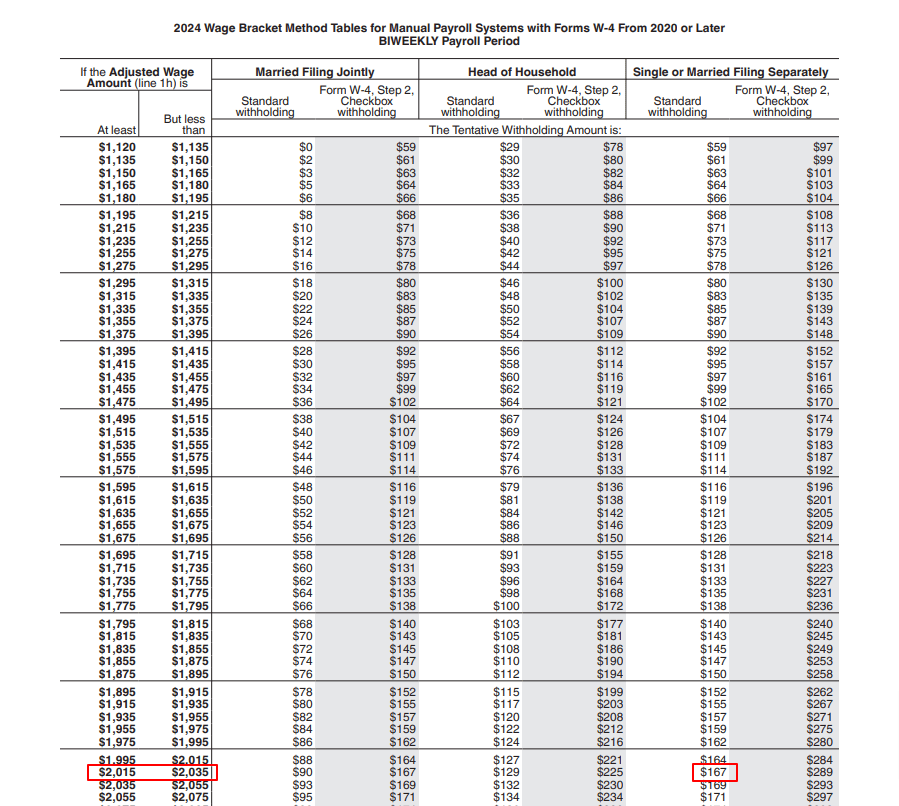

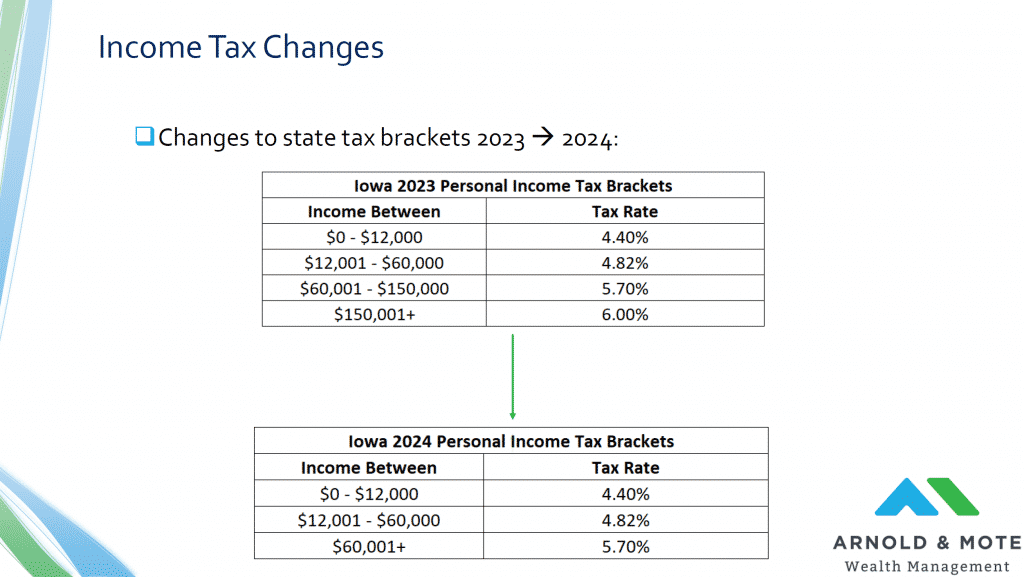

Withholding Tables 2024 - 10%, 12%, 22%, 24%, 32%, 35% and 37% (there is also a zero rate). It describes how to figure withholding using the wage bracket method or percentage method, describes the alternative methods for figuring withholding, and provides the tables for. For 2024 the estimated tax worksheet. There are seven (7) tax rates in 2024. The rate of social security tax on taxable wages is 6.2% each for the employer and employee. Here are the irs withholding tax tables for 2024 for employers that use an automated payroll system. The social security wage base limit is $168,600.the. The first federal tax table from the irs. Use your 2023 tax return as a guide in figuring your 2024 estimated tax, but be sure to consider the following. Here's how those break out by filing status:

10%, 12%, 22%, 24%, 32%, 35% and 37% (there is also a zero rate). There are seven (7) tax rates in 2024. Here's how those break out by filing status: It describes how to figure withholding using the wage bracket method or percentage method, describes the alternative methods for figuring withholding, and provides the tables for. The social security wage base limit is $168,600.the. The rate of social security tax on taxable wages is 6.2% each for the employer and employee. The first federal tax table from the irs. Social security and medicare tax for 2024. For 2024 the estimated tax worksheet. Use your 2023 tax return as a guide in figuring your 2024 estimated tax, but be sure to consider the following.

The social security wage base limit is $168,600.the. Here's how those break out by filing status: Social security and medicare tax for 2024. The first federal tax table from the irs. Use your 2023 tax return as a guide in figuring your 2024 estimated tax, but be sure to consider the following. Here are the irs withholding tax tables for 2024 for employers that use an automated payroll system. There are seven (7) tax rates in 2024. 10%, 12%, 22%, 24%, 32%, 35% and 37% (there is also a zero rate). It describes how to figure withholding using the wage bracket method or percentage method, describes the alternative methods for figuring withholding, and provides the tables for. For 2024 the estimated tax worksheet.

Irs Employer Withholding Calculator 2024 Aline Sashenka

10%, 12%, 22%, 24%, 32%, 35% and 37% (there is also a zero rate). The first federal tax table from the irs. Use your 2023 tax return as a guide in figuring your 2024 estimated tax, but be sure to consider the following. The rate of social security tax on taxable wages is 6.2% each for the employer and employee..

Tax Brackets 2024 Indiana Netti Adriaens

10%, 12%, 22%, 24%, 32%, 35% and 37% (there is also a zero rate). For 2024 the estimated tax worksheet. The rate of social security tax on taxable wages is 6.2% each for the employer and employee. Use your 2023 tax return as a guide in figuring your 2024 estimated tax, but be sure to consider the following. There are.

2024 Tax Tables Printable Lilia Francisca

Use your 2023 tax return as a guide in figuring your 2024 estimated tax, but be sure to consider the following. Here's how those break out by filing status: It describes how to figure withholding using the wage bracket method or percentage method, describes the alternative methods for figuring withholding, and provides the tables for. The social security wage base.

Irs Tax Withholding Tables 2024 Harri

For 2024 the estimated tax worksheet. The social security wage base limit is $168,600.the. 10%, 12%, 22%, 24%, 32%, 35% and 37% (there is also a zero rate). Use your 2023 tax return as a guide in figuring your 2024 estimated tax, but be sure to consider the following. There are seven (7) tax rates in 2024.

Withholding Tax

Here are the irs withholding tax tables for 2024 for employers that use an automated payroll system. Here's how those break out by filing status: The social security wage base limit is $168,600.the. It describes how to figure withholding using the wage bracket method or percentage method, describes the alternative methods for figuring withholding, and provides the tables for. There.

Tax Withholding Tables 2024 Cammy Jordain

Use your 2023 tax return as a guide in figuring your 2024 estimated tax, but be sure to consider the following. The social security wage base limit is $168,600.the. The rate of social security tax on taxable wages is 6.2% each for the employer and employee. Social security and medicare tax for 2024. There are seven (7) tax rates in.

Payroll tax withholding calculator 2023 SallieJersey

Here's how those break out by filing status: The first federal tax table from the irs. For 2024 the estimated tax worksheet. 10%, 12%, 22%, 24%, 32%, 35% and 37% (there is also a zero rate). Use your 2023 tax return as a guide in figuring your 2024 estimated tax, but be sure to consider the following.

Federal Withholding 2024 Tables Clari Justinn

For 2024 the estimated tax worksheet. Social security and medicare tax for 2024. The first federal tax table from the irs. 10%, 12%, 22%, 24%, 32%, 35% and 37% (there is also a zero rate). Here are the irs withholding tax tables for 2024 for employers that use an automated payroll system.

2024 Tax Rate Tables Married Filing Jointly Calculator Adara

The first federal tax table from the irs. Use your 2023 tax return as a guide in figuring your 2024 estimated tax, but be sure to consider the following. 10%, 12%, 22%, 24%, 32%, 35% and 37% (there is also a zero rate). It describes how to figure withholding using the wage bracket method or percentage method, describes the alternative.

2024 Tax Brackets And Deductions Cody Mercie

For 2024 the estimated tax worksheet. Use your 2023 tax return as a guide in figuring your 2024 estimated tax, but be sure to consider the following. Here are the irs withholding tax tables for 2024 for employers that use an automated payroll system. Here's how those break out by filing status: Social security and medicare tax for 2024.

There Are Seven (7) Tax Rates In 2024.

10%, 12%, 22%, 24%, 32%, 35% and 37% (there is also a zero rate). Here's how those break out by filing status: Social security and medicare tax for 2024. Use your 2023 tax return as a guide in figuring your 2024 estimated tax, but be sure to consider the following.

The First Federal Tax Table From The Irs.

It describes how to figure withholding using the wage bracket method or percentage method, describes the alternative methods for figuring withholding, and provides the tables for. For 2024 the estimated tax worksheet. The social security wage base limit is $168,600.the. Here are the irs withholding tax tables for 2024 for employers that use an automated payroll system.